Recently we were pleased to bring you a webinar featuring Erick Simpson as our guest expert. Many readers will know Erick as a renowned MSP business and channel growth expert, influencer, thought leader, author, speaker and consultant. You may have seen his speaking engagements at MSP industry events in years passed. Erick is an excellent orator offering countless nuggets of wisdom, and we hope you enjoy his presentation as much as we did.

Watch the webinar on YouTube or read the transcript below for valuable insights into growing your MSP, acquiring an MSP, or selling your MSP.

Hartland: Perfect sounds good thanks. Everybody excellent session that we have planned today. I’m very pleased to introduce Erick Simpson, I’ve known Erick for many years. We met each other at numerous conferences and every time we speak with him, love tapping into his experiences and sharing frankly experiences between each other. So I’m going to let Erick introduce himself in a minute. I think most of you probably know him, but for those who don’t I’ll, let him provide a little bit of background I’ll do that in a minute. But if you’re looking for any kind of support for your I.T. firm, you really do need to have a conversation with Erick first. So Erick great to have you join us today. I know that you and Devin work together on some ideas for today’s session and I think that frankly with all that’s going on right now in the world, really there’s no better time than now to be sharing your wealth of wisdom on operationalizing I.T. service firms and MSPs and whether it be to maximize the value of your own, firm or use today’s session. As a bit of a filter to evaluate firms or both so Erick, I’ll let you drive so to speak here, and over to you, but I know I’ll have probably some questions and I’m sure our attendees will as well, so I’ll let you run with it.

Erick: Thanks very much Hartland, so I do have Devin’s intro up. You want me to just…you want to introduce Devin and then I’ll skip over to you and then we’ll take over?

Hartland: Yeah sure. So, first of all, eBridge Marketing Solutions is a marketing firm that we started back in about 2001, 20 years or so ago. We’re a boutique market agency serving MSPs and really I.T. service firms. For us, the ecosystem includes web hosts, data center providers, infrastructure providers and managed service providers, and we provide a full range of marketing services. And then about 15 years or so ago, we were working with a lot of our clients and they were wanting to grow a bit more quickly than they could through organic methods and were looking to see if there was some also some cheaper alternatives, and could they grow through acquisition. And at the same time, we had other groups who were looking to sell or partnering with perhaps larger groups, that would allow them to either exit the industry or grow more quickly. And so we ended up building out our M&A practice and hence the start of The Host Broker and our M&A practice.

Hartland: And so fast forward to today and we’ve got a thriving M&A practice where we’re putting buyers and sellers together. So if you have any questions on that front, please get in touch with us directly. I’m going to hand it over to Erick here who’s going to take us through a session that is kind of near and dear to my heart. In terms of how to structure your business for either buying or selling, and we look forward to Erick’s session here, so Erick, take it away.

Erick: Thanks very much Hartland thanks and thanks for that very gracious, introduction. I’m really excited to get the band back together, as we say, and to deliver, I think a session that is very timely, for us today, as we come through this very uncertain year of response to the pandemic and lockdown and uncertainty as to how long this is going to affect all of us. And how soon before, we actually, get back to a sense of [normalcy]. I don’t think that we’ll ever get back to [it].

Let me turn my video on really quick, so I can shock everyone. I was sharing…everyone hey! This is Erick Simpson. I was sharing with Hartland a minute ago that this will be the first time that I share the accident that I had with some clippers that I bought from Amazon. So if you can relate to, having to do things on your own that you haven’t had to do before. One of my younger sons asked me a few weeks ago to kind of just, trim all of his hair off, and so I adjusted this thing down and did his and I’ve been doing mine, every few weeks through the pandemic and leaving a few inches of hair. But I forgot to check before I did my hair the other day and clipped it. I had the settings that I had used on my son. So now…I don’t remember what term you use Hartland, but was it sleek? I don’t know, but I just took it, I did one swipe, and I just I had to finish it.

Hartland: I said you looked fast.

You should be paid for everything that you do, and you should be invoicing for everything that it takes for you to onboard a new client.

Erick Simpson

Erick: So anyway, thanks everyone for attending and taking 60 minutes out of your busy schedule, as I always like to say, working on the business rather than in the business. So here’s a little bit about me. I’ve been in the industry for, a blink of an eye here in internet time and have focused on helping business owners improve their organizations all the way through developing strategies, for growth through acquisition or exiting at the highest valuation. And, as Hartland mentioned, that’s kind of how we know each other from working together, in some of these endeavors and helping partners and business owners like yourselves really get the most out of the entrepreneurial dream.

So, as I was leading up to my what I was saying earlier in the intro, what does next year look like? When are we going to get back to a semblance of the next normal, right, because I think from the conversations I’m having with business owners, a lot of them are really saying well, wow, moving to the cloud, wasn’t that painful? You know we had to move to the cloud to support these remote workforces, and we may continue having remote workforces and work from home. So by show of hands, how many of you are contemplating or know if the leadership in your organizations are contemplating continuing exploring this kind of work from home opportunity? Even if and when things get back to kind of what we used to know…raise your hands and let us know, and I’ll share how many folks raise their hands. So probably a quarter of us so far are considering that, right. And this is being led – oh, maybe there’s a few more hands going up; okay, put them down thanks for that. So I think this is being led also by some large enterprises also saying the same thing. We’re hearing this from large enterprise organizations. You know the fortune 1000, the fortune 500 – that are saying this may be a way for us to, to offer more benefit to our staff, certainly save on some costs and things like that. But that always does come with a caveat, right. There’re always some cons to the pros, so we’ll see how that shakes out. But a couple of things that we’ll talk about today and I know Hartland you’ve got a list of questions that we’ll be doing during Q&A that that bring kind of what we’re sensing from the folks that we’re working with to light, right. Some big questions that that we’re being asked that we’d like to share and then open the conversation up. And please, please use the chat function. Use the Q&A function so that we can make this as an inclusive and an engaging conversation as possible. I’ve got to open up my chat function here. There we go. Okay. I think I can see very well okay.

Erick: So, let’s move right on into today’s topic. So now, by show of hands, how many of you are operating or work in a technology focused business today? Raise your hands and let us know real, quick, so 50%, 60%, 70%. Very well awesome! Thank you for that. Put your hands down, please.

Hartland: I would think we’d have almost 100%, if not 100%,

Erick: So yeah I mean and what we’ll cover today applies to the majority of business. But there are some specific KPIs that I’ll be covering that really impact kind of a technology-oriented organization. For instance, this particular slide, ‘11 metrics that every SaaS company should care about’, from HubSpot’s eponymously named blog. You can find it if you search 11 metrics every SaaS company should care about. There’s a link there at the bottom you’ll be able to hit [for what] I think is a valuable blog post from HubSpot. If driving customers is your ultimate goal, then maintaining your existing customer base is critically important. Your customer churn rate measures how much business you’ve lost within a certain time period, and this metric can help you understand customer retention. Now, just because these are SaaS focus metrics, they all apply to normal business as well. We’re all concerned with customer churn and the resultant revenue churn when clients leave us. We’re always seeking to improve customer lifetime value and to introduce additional benefits and customer experience, improvements to increase that customer lifetime value.

The last thing that you want to do is wake up to that email from a client that you had no suspicion was unhappy asking for their administrative passwords.

Erick Simpson

How many of us really track some of these other metrics, though, is the question. We typically see these metrics in more of an evolved or mature business. Tracking your cost of customer acquisition is a key to identifying your marketing and sales ROI; and then tying that back to customer lifetime value really gives you kind of an idea of how many months it will take for you to recover that cost of acquisition. So how long after you acquire a new customer are you actually meeting your margin targets by delivering service to them? I speak with my specialty [of] managed service providers, and the folks that I speak with sometimes say something to me like: “well, we achieve breakeven in about 90 days when we bring on a new customer.” And I say: “why is it taking you so long, why is it taking you so long to achieve breakeven?” You should be paid for everything that you do, and you should be invoicing for everything that it takes for you to onboard a new client. So if you’re looking at your solution stack, and you’re looking at your deliverables, and you’re looking at your onboarding process, my recommendation to you is to ensure that you’re tracking everything that it costs you to onboard and deliver service to an existing client, and make sure that you’re adding that, and you’re meeting your margin targets.

So where do I see situations where there could be some erosion of that margin? Number one is not having a documented, established, consistent, onboarding process for every client. So that we’re doing the same thing, the same way for every client that we onboard so that way we can measure how long it takes, and we can understand what our costs of doing that are, and incorporating that into our ongoing fees. Now, some of us choose to charge an onboarding fee on top of a managed service agreement, and that’s fine. There’s nothing wrong with that. You know we used to do that too, before we sold our MSP practice back in the late 2000s. I’m sorry! 2007… late two thousands I’m from the future, by the way, if you haven’t figured that out yet, but I meant to say the tail end of it, before 2010. [Then] we would charge something like an amount equal to the first month. But that brings sales challenges. Clients typically don’t want to pay for something and then pay for something again right? Kind of double billing. So there’s nothing wrong with trying to get paid for your work, but we found that charging an additional onboarding fee sometimes created a sales objection.

How many of you have encountered that? Raise your hands really quick – a sales objection because you’re charging an onboarding fee and then having to negotiate that at some point because it is an onboarding fee. Okay, maybe a small amount of us so put your hands down please. So, even though it is an onboarding fee, when you’re negotiating that, you’re typically then negotiating on price, which is kind of the enemy of margin and protecting that margin. So what we decided to do was incorporate that into our monthly fees, so kind of delaying the cost of that. So the client pays upon agreement signature, which then begins the onboarding process, and we deliver service on a best effort basis until we completely provision them. Then everyone is trained and we establish a go live date. So kind of three phases of onboarding, and then upon go live is when we are held accountable to our SLA. Up until that point, it’s best effort. So that seems to kind of smooth out the rough edges of that negotiation. We want to sign the client right away. We want to collect that first check, and so that’s a good way to go in my experience.

So getting back to some of these metrics: client acquisition cost to client lifetime value ratio. So again just tracking how long it takes us to get to a breakeven point, and to me your breakeven point — you should be profitable when you sign a client remember, you should be getting paid — it’s kind of like, you don’t want to take your car to the dealer or the service shop or something and then pay…you know, wait…forget I even said that. I was going off down a rabbit hole on a tangent, but you get what I’m saying right? You want to make sure that you’re getting paid for everything you do. Your mechanic is not going to not get paid for doing diagnostic and things like that and then waiting and hoping that you’re happy with what they did, and then [let you] decide [whether] to pay them. So it removes a lot of these challenges. So how long does it take for you to realize that margin potential? I say as quickly as possible.

MSPs as a whole have some more maturing to do in terms of diversification, in terms of strategic reading that crystal ball, and skating to where the puck is going to be rather than where it is today.

Erick Simpson

What’s your customer engagement score? This is different than a customer satisfaction score. So we’ve all heard of net promoter and we’re familiar with these surveys that let us know [whether] a client [would] recommend us to someone. That has been touted as the most important question that tells you how satisfied a client is: if they will refer you to someone else. But I’ll, put you on the spot and ask you how many of you folks are asking for referrals on a consistent basis, because the majority of partners that I work with act like it’s a foreign concept. I mean they know they should be doing it. But how often are you doing it? You should be doing it at the end of every project, should be doing it during every technology, business review meeting or quarterly business review. And I expect you to close those referrals, so [you] don’t get extra brownie points for closing referral business. Adding to that, well, we closed 90% of our sales. When you can close 90% of sales in a cold market, then you’re a superstar right? Doesn’t typically happen. So I expect you to ask for referrals, I expect you to close those referrals. The customer engagement score is: how engaged are your customers with you? Do they understand and appreciate everything that you deliver for them?

How many times have you gone into a client’s business and found that they’ve purchased a product or service from someone else that you sell? It’s happened to me; I’ll be the first to raise my hand right. That’s embarrassing. That means we’re doing a poor job of engaging with our clients and informing them of everything that we can do to help their business. So they’ve found a need and a pain and they’ve gone somewhere else to get it solved when we’re sitting right here ready to deliver that. So shame on us. So that’s engagement score. How often are you engaging with your clients? How often are you having your business review meetings? I don’t expect you to have business review meetings with every client every quarter, that’s crazy. But for your A clients? At least quarterly. With your B client, semi-annually. And with your C customers, not at all, they don’t merit that high value. They’re C customers because they’re probably technology averse. They probably aren’t budgeting for investments and improvements in their technology, and they probably don’t see the value in meeting with you strategically. You certainly don’t have time to meet with them, because you’re too busy meeting with your A and B clients, as it should be. In today’s remote reality, we’re doing these QBRs remotely, we’re doing our sales calls remotely. So I’m teaching a lot of partners how to do these things using remote tools and platforms like Zoom and things like that. So if you’re not moving in that direction, [which] I suspect most of you are, get there quicker. Because we’re gonna be remote working and your customers will be remote working, probably through Q1 (if not certainly Q2) of next year.

Are you measuring your marketing traffic? How many of you are using digital marketing? How many of you are using social media? How many of you are email marketing? How many of you are doing virtual event marketing – webinars, things like that — to engage your target audience, and how are you measuring that marketing traffic? What are you doing? It’s not enough to just simply send out emails and post on social media. But how are you analyzing the data? I was surprised recently to find that — I think I’m an okay marketer I’ve been doing it for a long time, and just the disparity between the effectiveness of my email marketing versus my online social media marketing…I mean it wasn’t even close so I’ve definitely got a lot of work to do to improve my social media marketing efforts and outcomes. Or just realize that social media isn’t really a medium to register folks directly for live events, for me anyway. But maybe [it is good]as an added reminder or an influencer of the folks I’m already emailing anyway. I’ve got a lot to figure out there, I’m not a master marketer by any means but I started tracking these metrics and going: “That’s interesting. I did not even realize that I needed so much work in that area.”

How many leads are you generating by life cycle stage? What is the life cycle of your marketing list? How old are the leads in the marketing list? How many times have you touched them? How many activities have these leads taken action on? So again, we’re kind of breaking down the dynamic of how many people have clicked on something? How many people have visited a webinar or downloaded a lead? [Lead] magnets such as a white paper a case study from your website, and what have they done as a result of that, or what is your follow-up process as a result of that. Kind of going back to a concept that I developed back when I had my MSP, [a] client solution road mapping strategy that says figure out every possible thing that a business owner might need to run their business and figure out the things that you deliver. And then for all the other things, develop referral relationships with others to help those clients. So you become much more valuable now, as you have more strategic discussions about what it takes to solve business problems for a client that sometimes transcend technology. Everything typically ties back to technology, even if you’re referring accountants and other folks to your clients. But as a result of that, how do you increase the client lifetime value of every one of your clients by introducing all of these other ancillary products and services, and not think that you’re kind of a siloed vendor. You want to be known as that strategic business partner that really adds value to your client relationships and, in many other ways, lead to customer rates.

The more mature and better prepared MSPs have not only weathered the pandemic but have actually grown through the last nine months.

Erick Simpson

So that’s the conversion rate, and then [there’s] your customer health score. So this goes back to that other type of survey, not the customer engagement score that we talked about, but that net promoter score; the customer health score which the customer engagement score becomes part and parcel of. So these are really specific metrics that give you an idea of how you’re operating from different business units that all lead to profitable business growth. Customer churn, customer lifetime value, how long it takes you to be profitable when you bring a customer on, their engagement score, how well your marketing is doing, and how well your sales closing ratio is, that lead to customer rate, and then once they are a customer, tracking their health. Are they green? Are they amber? Are they red? The last thing that you want to do is wake up to that email from a client that you had no suspicion was unhappy asking for their administrative passwords. We all know what happens next right? So if you’re not tracking these things and [not] really understanding where your customers are in their relationship with you, then we tend to be surprised by these things. If you’re tracking most of these metrics, especially the customer related ones, you’ll identify some of these things early on and [will] be able to either address them, and correct them, or understand that this is something that you may not be interested in correcting and it may be beneficial for both of you to part ways. It’s okay to leave. You know for customers to leave you or for you to leave customers when it is a strategic decision. So maybe, for whatever reason you want to, you know, support the exit of a customer. You may have outgrown them; they may become too noisy and unique. They don’t want to invest in a higher level of support from you for you to be able to give them what they actually need, and the opposite is true too. You know some of us fail to grow quickly enough to stay ahead of our customers needs and they outgrow us. So it’s kind of that circle of life. We have to understand where we fit, and maybe we bite off too much, [more] than we can chew, or maybe we’re not evolving fast enough to meet the needs of our larger clients. So that’s just the cost of doing business and learning along the way.

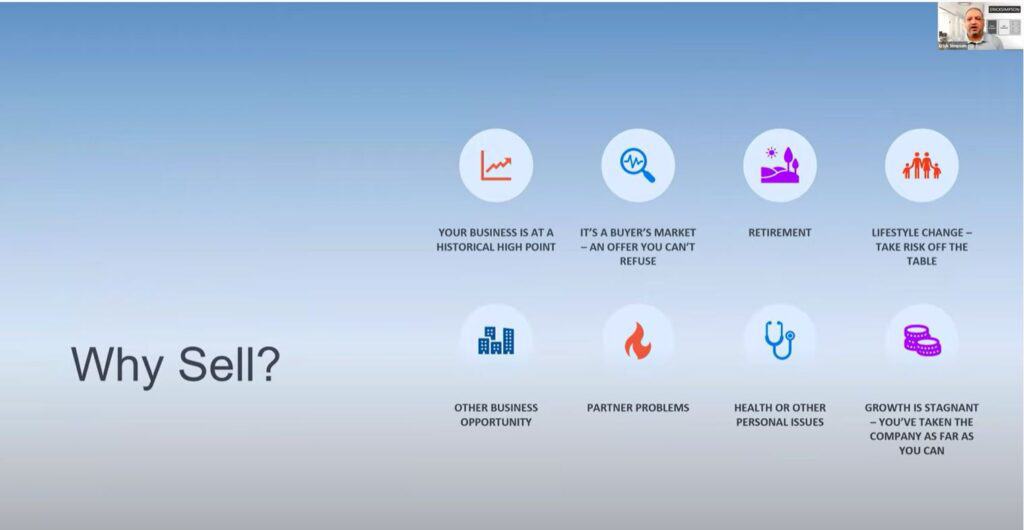

Erick: So, let’s discuss reasons you may want to sell the business you built either now or in the future. This decision can be based on multiple factors, including having reached the highest operational performance level that you can take the organization [to] and you may not be interested in partnering with someone else or anything else. You’ve taken it to where you want to take it. Maybe you’re at a point in your life where you’d like to do something different, have different interests, or whatever. You’ve taken it to the historical high point. That may be good enough, because now you can command the strike price that you’ve been hoping for all along. Or it may be a buyer’s market, and we’ll talk about that here in a minute. You may be approached with an offer that you can’t refuse, or maybe it’s [that] you could refuse it, but you may be able to continue that conversation to make it more interesting. You may decide that you want to retire, hey you’ve put in energy, effort, and you may be at a point where you’re ready to move to the next stage and enjoy the fruits of your labors. There may be a lifestyle change, something unexpected or expected. I mean I work with partners all the time that have changing lifestyle requirements, i.e., maybe having to take care of an older family member or welcoming a new member to the family. Things like that, you maybe, need to focus on something, and this may be planned or unplanned., Maybe there’s more risk, and you want to take some of that risk off the table and think that an exit might help in that transition. You may be approached with another business opportunity that that would take so much focus away from your current business that it makes logical sense to look at opportunities to sell so that you can devote your energy efforts and attention to that new business opportunity. You may have a partner problem. I hear this one quite often. Partners can’t get along and are looking for ways to exit, and these are tricky. In my experience, I mean it’s, it’s almost like it’s a divorce. Really. And everybody wants to make sure that they get what they feel they’re entitled to. So it’s those that are tricky exits. And sometimes tricky and stressful and sometimes frankly bitter, so not the best at times. So again, that and the relationship may have gotten so toxic, that the only way for these partners to recover is to sell. And sometimes one is selling to one of the other partners, and sometimes that gets tricky as well. Health or personal issues, right? Tomorrow’s not promised to us. So, unexpected events occur that again refocus our attention, unexpectedly, sometimes or maybe, you’ve just taken this the business as far as you can. I think I mixed those two up at the beginning. You know one is you’ve taken it to the highest performance point, highest valuation, it’s a great time to go and seek offers. The other one is, look, I’ve just taken it as far as I can take it and I’m not interested in another five years of growing and trying to get it somewhere else. I mean, I’m maxed out and I’m ready to entertain some offers. So there’s a lot of different reasons why you might consider selling.

If you’re the CEO and the president and you are not taking steps to replace yourself so that the business operates autonomously, profitably, and successfully without you, you’re failing to increase shareholder value — even if you are the sole shareholder.

Erick Simpson

Hartland: Erick, if I can add in just from my experience as well and a few points that I think relate to the ones you’ve brought up here so far. But one of the ones that we see quite often is passion, loss of passion which one could argue is a bit about a lifestyle change, but in some cases it may just be a loss of passion of that particular business and they’ve got another opportunity they’re pursuing. That’s a reasonably common one. Another one that we see particularly on the hosting side, where there’s a lot of infrastructure, is [when] there’s a requirement of an investment of capital, and so they’re at the point where it’s kind of a point of inflection for them and they need to either make a commitment financially that’s significant and that they may not be willing to do. So they are either looking for a partner or perhaps [to] use that as an opportunity to exit. And then another one I was thinking about too was — and we see this in a number of instances where maybe a customer or two left, and significant customers. And now particularly if they’re in smaller markets or something, and there’s some fixed costs associated with supporting those customers, and now the revenue just isn’t it there to support the fixed costs, and they’re in a situation where they either need to grow the revenue, or every month is actually costing them money, or they’re not making any money, and so they’re motivated to make a move. So [that’s] another reasonably common situation, particularly in infrastructure but frankly, I’m dealing with it with an MSP right now as well.

Erick: Now those are definitely factors that can influence a decision. A difficult decision and I’ll liberally steal from those later and add to my slide. So thank you for those Hartland. You know when you mention the loss of passion, immediately I’m like: I don’t know how many of you are like a soundtrack person. Like someone says something and I think of a song immediately, and I immediately thought the thrill is gone baby, the thrill is gone.

Hartland: That’s the cue to play the music right now.

Erick: That’s right! The thrill is gone. Oh, that’s, perfect! Awesome! So let’s explore some reasons to buy right. So just as we have reasons to sell, some of us are the opposite. We say no, we want to grow through acquisition. The fastest way to add top line revenue to an organization sometimes is to buy another organization. And note I said “top line”, because the devil’s in the details. If you don’t have a great integration strategy, and a reason for why, you’re buying. And integrating sometimes profitability is. You know it’s difficult to chase, but notwithstanding that, maybe you want to expand your geographic coverage. Maybe you know there’s an opportunity for you. You’ve moved now more toward the cloud. You’ve experienced this — you know — a positive outcome from what we’ve just gone through for the last nine months and said, oh, it’s made me shift to deliver more remote services to customers. And wow, I can now sell these in a much broader way. Maybe there’s an opportunity now for me to buy a couple of geographically distant organizations to help further that expansion. Maybe you have a unique product, service, or solution, or process that other organizations see an opportunity for. They have some things that fill in some gaps in your stack, you have some things that fill gaps in their stack, and it makes good strategic sense to join forces. So maybe you acquire them, and now you have a huge cross-sell opportunity between the two entities. So there’s lots of reasons beyond that cross-sell. So expand into new verticals or sub verticals. You know I’m going to be doing a webinar later this week about doing work with government entities, so maybe there’s a… and I’ve worked with a lot of partners that focus completely on federal, local state government, and things like that that. That’s all they do and they are very attractive to other organizations that want to do business with the federal and local and state governments, and things like that. So these are expanding into new areas [and] created that larger organization with centralized economies of scale. So, together we can save on costs by integrating and maybe eliminating extra processes or departments or things like that. I know it sounds a little bit harsh when it’s probably presented in the wrong way, but you don’t really need two accounting departments and two marketing departments and things like that when you’re integrating, so these economies of scale can be had and can ultimately reduce the cost of the larger organization, rather than continuing both organizations operating independently. In addition to some of these other value factors, and the last one, hey remove a stubborn competitor right? You’ve been fighting all this time. Finally, let’s just join forces. So Hartland, I’ve given you my top five here. What else? What else would you share?

Hartland: You know what, it is very timely, so I have one more. It came up this morning on a call that I was with and it comes up fairly frequently which is: acquisition of talent. That talent is dependent on the market and whatnot. I mean one could argue it’s easier right now with COVID, and perhaps [that’s true] in some ways. But in some markets, acquiring talent is difficult, and through an acquisition, now all of a sudden you’ve got the talent. And you’ve got not just talent, but it’s talent that’s trained! It’s talent, that’s familiar with the customer base, it’s familiar with the services and the nuances associated with the market and with those customers and with services being provided.

Erick: You know I hear that one a fair bit, you’re absolutely right and that I should have that on the slide. Because I’m promoting that to clients that have — prior to this pandemic the job market was so tight. I mean unemployment is at all-time historical lows: it’s tough to find good people. And so the decision to make acquisitions, I promoted that as a way to gain that new talent, so you’re, absolutely right. It should be on my slide, so thank you for that.

Erick: So what are buyers looking for if you intend to sell and what should you be looking for if you intend to grow via acquisition? According to Forrester, desirable acquisition targets embody the following traits: a solid management structure that allows the business to operate independently of the owner. So nobody wants to buy a job you’ve created for yourself, right? And you shouldn’t want to buy a job that was created by the owner, who is now indispensable in the operation and growth of that business. Unless there are some extenuating circumstances, right the business. These are the most desirable traits that drive the valuation: high consistency in the business in terms of controlled sustainable growth, with low staff and customer churn. Really important right when you’re looking at an organization, if they can’t seem to keep staff or customers, red flag, right Hartland? I mean that’s like what’s happening here, consistent and steady revenue, growth skewing towards higher recurring revenue, diverse revenue sources, comprised of a mix of subscription-based and project-based services, with a focus on professional managed IT, cloud and security services, and, especially attractive, our niche or vertical market line of business expertise and AI and BI competencies. So when, when I look at recurring revenue and helping with evaluation exercises and things like that, I’m not just looking at managed IT services. Everything that is subscribed to and paid for on a monthly basis or annual recurring basis on a subscription. So annual recurring renewals also count toward recurring revenue that can increase the ultimate valuation of an organization. And solid, consistent cash flow with high on-time receivables collection, and low percentage of uncollected revenue, or our day sales outstanding right. So you want to make sure that not only is the organization delivering service in a timely basis, consistently growing financially, but they’re also collecting their invoices in a timely manner.

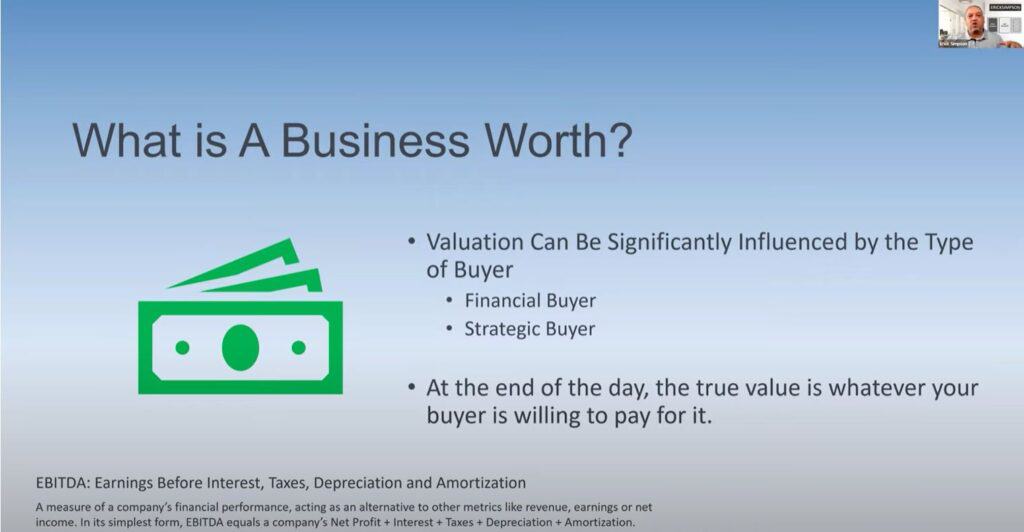

Erick: So, to put a fine point on all of this, your business valuation can be influenced by many factors. Not the least is what your buyer is ultimately willing to pay for it, or you are ultimately willing to pay a seller.

Now, valuation can be affected by the type of buyer, so we always talk about this, right Hartland? There’s the financial buyer and there’s the strategic buyer. So financial buyers really are more focused on the numbers, on business performance. So they’re. Looking at, you look at these folks that are doing roll-ups and things like that. They’re looking at financial reasons to acquire an organization and if you’re a financial buyer, even if you’re a strategic buyer, the financial conversation is going to come into play. But it may not be the primary driver or determinant we talked a minute ago about. An organization having a unique product, service, or solution, or in a unique specific vertical market, or geography, all these things can add to the strategic, you know, tick boxes, check boxes. A strategic buyer is looking to fill a gap or seize an opportunity to introduce what they have into that other seller’s customer base. So we’re looking more strategically so maybe that organization, if you’re looking to grow through acquisition, has a strong Microsoft Azure practice – and you don’t, and that BI and AI is where it’s going to be, and robotic process automation. Maybe they have some of those skills and so you’re looking for the future opportunity and see it more strategically. Then perhaps financially you may buy an organization that may not be doing very well or struggling financially because they don’t have a strong marketing and sales team, but you’ve got a crackerjack marketing and sales team and know that you can take what they have and really blow it out. You know whether I’m looking at this from a purely financial perspective or from a strategic perspective, typically, not always, but typically strategic M&A discussions may yield higher valuations because we’re buying this organization more than just for its financial performance. Like I said they may be flat in revenue, but with a couple of judicious tweaks and tunes and bringing your influence to bear, you can supercharge the performance of that organization or add to what you’ve got. I think another important point there is just kind of time to market. In some instances there may be an opportunity to jump either whether it be expertise in a vertical or rolling out. You know whether it be Azure or some kind of specialization. Now, from a strategic standpoint, if that’s going to take you a year or two to kind of build that that competency and whatnot, you may be willing or a buyer might be willing to pay extra for that, and more so than a financial buyer, because it doesn’t make sense for a financial buyer. They just look at an alternative option. But for a strategic buyer, that’s on their radar, that’s part of their strategic plan.

[Selling your MSP] is probably the most complex transaction you’ll ever have experienced…so much is uncovered and turned over to someone that you’re just trying to earn some trust [with] and build a relationship with.

Erick Simpson

Hartland: I was curious, Erick. What’s your sort of take here? I mean for those of you who don’t know I mean Erick spends like… if I think I’ve had a long day on the phone… I mean gosh Erick is like back-to-back all day long, probably seven days a week. So I know you talk to a lot of people and I’m curious, what’s your sense of not only from your own experiences, but from what you hear out there in terms of financial buyers versus strategic buyers, more financial now than there used to be? More strategic now than there used to be? What’s what? What? Where? What do you make of those trends in this particular space?

Erick: I mean. Obviously, financial buyers have been around forever, but in terms of like IT services, yeah, I think prior to the pandemic. I’d say that. I think that as a rule, I’m going to… You know I’m going into dangerous territory here. As a rule, I think financial buyers have always been more opportunistic and prevalent. Strategic buyers [are] fewer and far between, and I think that, as a result of the pandemic, what we’re seeing is even more opportunistic financial buyers. I think that if we’re looking at MSPs as a whole, and don’t hate me everybody for saying this, but I think MSPs as a whole have some more maturing to do in terms of diversification, in terms of strategic reading that crystal ball, and skating to where the puck is going to be rather than where it is today. A very small percentage of MSPs are at that maturity level, that level five of operational maturity, where they’re actually innovating and trying to skate to where the puck is going to be and looking at these are the early adopters of the new technologies and the new services. So folks that have jumped on, buy early folks that have jumped on Azure and cloud services early on in security and security — well, security, yeah, obviously they’re still, I’m still scratching my head as to why there isn’t more of a stampede towards it. I think it is the largest opportunity, the gold rush opportunity for IT providers and MSPs that has ever existed and I tend to see the adoption of it almost like when I was helping partners 15 years ago adopt managed services, it’s kind of like it’s here for the taking. You know you have to adapt and I also think that there’s this other phenomenon Hartland, where the MSPs that were around at the very beginning of managed services now are older and more mature and maybe looking to exit. So we’re seeing that, where we’re not going to see them adopt new technologies potentially and rush to add additional business units; they’re now kind of at the point where they’re looking to exit potentially. So there is a lot. I think you tell me Hartland what you sense, but I think there are more MSPs that see they’re building their organization as an exit strategy through a sale than as a growth through acquisition kind of a business vision strategy. What do you think?

Hartland: Well, I think that everybody is looking at it through the exit lens.. Maybe have a long enough runway where the acquisition is kind of the next steppingstone, an acquisition (or two or three or four), with the ultimate vision of that exit. You know, and certainly we’ve got the those with some gray hair and those without and so, I think it depends on where they’re at in that spectrum as well. I think that we’re seeing a lot of more historical especially more break fix operators that, are kind of closer to retirement and may feel that it’s too much work to convert into a managed services offering. But those who have got some runway, I think want to kind of capitalize on that and then cash out in a number of years still.

Erick: Yeah and I think the pandemic unfortunately has accelerated the exit of a lot of the smaller MSPs. You know not because they wanted to, but just the reality. The more mature and better prepared MSPs have not only weathered the pandemic but have actually grown through the last nine months. So by show of hands everybody. How many of you have seen your revenues actually grow over the last nine months? Raise your hands for us and it’ll be interesting. Certainly you hear both sides of the story. About a quarter of you have raised your hand so appreciate that. Put your hands down, and I would argue there’s probably more than that, but some people here probably wouldn’t put their hand up because…okay, so those of you that won’t raise your hands just send me like a winking eye emoji, no matter what I have so I know not to…I’m just kidding. So really quickly, I know we’re getting close to the top of the hour. I have barely cracked my slide deck, so I’m going to speed up really fast a little bit here, Hartland.

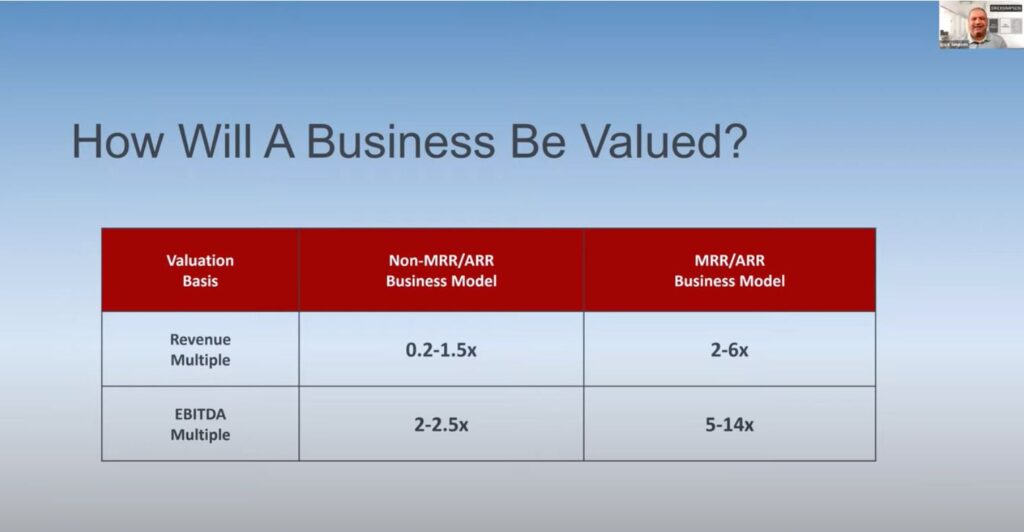

Erick: So just kind of an example of what the value differential will be for an organization that is being measured from a valuation perspective solely on EBITDA and revenue multiple as a comparison of the percentage of their revenue that is monthly, recurring or annual recurring revenue. You can see a quite a dramatic increase in organizations that have a larger percentage of their revenue be on a recurring basis, and I’m not talking about verbal agreements where you’re, just, invoicing somebody every month that they’re paying IT. I mean these have to be documented agreements, long-term agreements are better than short-term agreements, agreements with auto renew language in them, value better as well. So just think about this, and I like to say that a healthy mix of recurring revenue for an organization is anywhere north of 60 recurring, and remember I’m including subscriptions of services as well as annual renewal of services too. Not just managed IT services, but everything that you’re selling to those organizations that is under an agreement and they’re paying for on a recurring basis. So any thoughts on that Hartland?

In order for us to skate to where the puck is going to be, I think we’ll be focused more on the cloud and security and that kind of stuff and less on infrastructure.

Erick Simpson

Hartland: Look, I mean that’s an hour of discussion on its own. I think valuations is a tricky one.

Erick: There’s a whole series of webinars there right.

Hartland: There really are, and probably we should do one on that, but yeah I’ll leave it at that for now.

Erick: I think those of you that have a higher percentage of recurring revenue, probably have been able to weather things like the pandemic, or other economic downturns, historically better than your colleagues that have a lower percentage of recurring revenue. It’s almost an insulator. Not to say that it’s not impacted, but what we see in statistics is that MSPs with a higher margin, higher percentage of recurring revenue tend to weather economic uncertainty much much better than those on the other side of the fence.

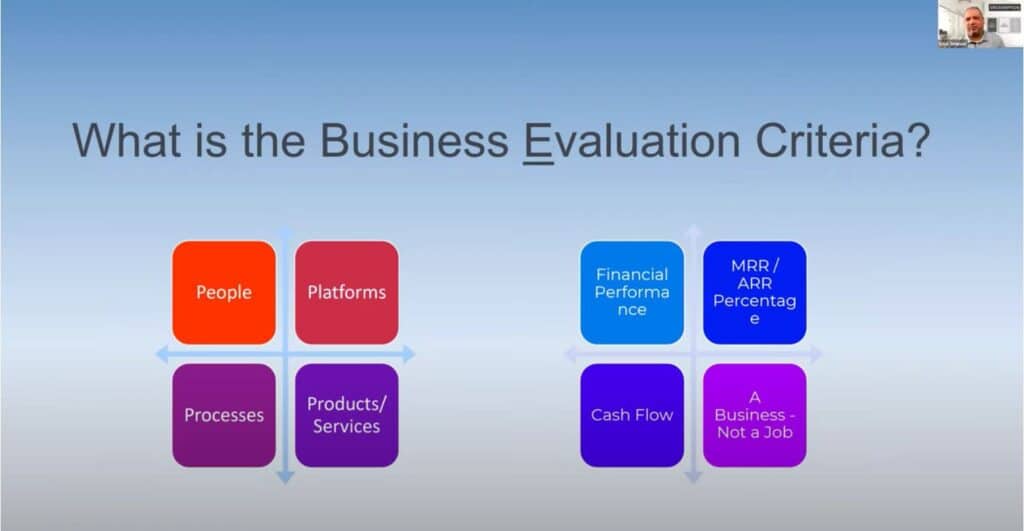

Erick: So, what’s the business evaluation? There’s [also] valuation, how much am I willing to pay right? How much is it worth?, But what’s the evaluation? An evaluation impacts valuation, because if you’ve got the right people, your platforms are in place and configured properly, your processes are documented and everyone is following those processes consistently and you’ve got a solid stack of products and services. You know I’m going to evaluate the business in a much more positive light in addition to financial performance, your MRR percentage, your cash flow and again an actual business, not a job that the founder has created for themselves.

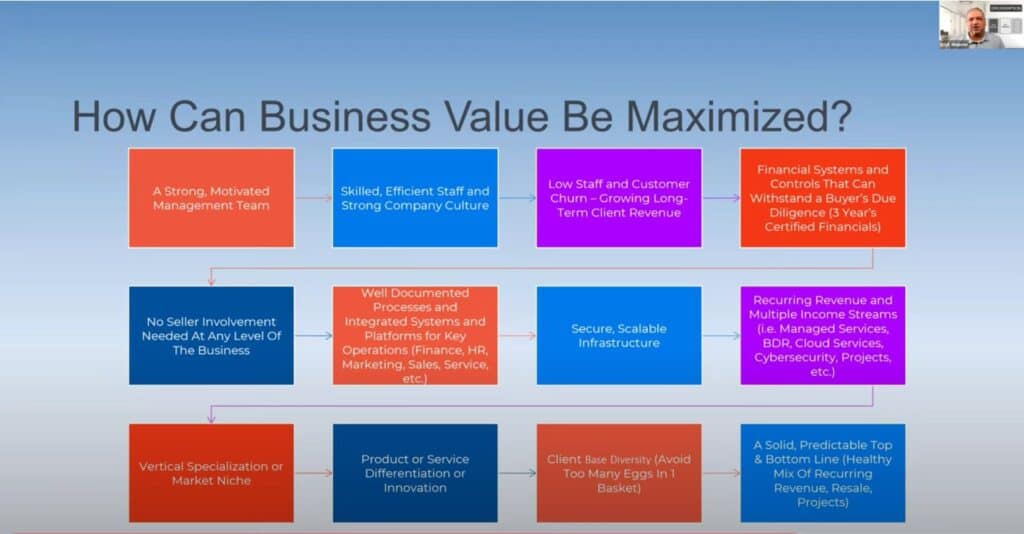

Erick: Wow. So this is a busy slide so how can business value be maximized. And I’m totally fine Hartland if you’d like to send a copy of the slide deck out to everyone today afterwards? So you guys can actually pour into this because there’s a lot of slides with a lot of data here and I don’t like doing death by PowerPoint. So that’s why I try to do video and raise your hands and things, but there’s a lot of ways that business value can be maximized. I’ll just pick a couple out of here: well-documented processes, integrated systems and platforms. Typically when I consult with organizations, I work off the 4 P principle: people, processes, platforms and products and services. So there has to be a solid performance from each of those areas, and people is probably the most challenging because there’s people involved right. It’s not platforms that we can configure and optimize. It’s not processes that we can do again. We have to hold the people accountable to executing those activities. And your product and service, that’s your solution stack, your product portfolio. I mean once you get that figured out, where your costs are and what your target margin is, I mean it’s pretty baked. The people part is kind of a moving target here. Client-based diversity right? Avoid having too many eggs in one basket. You know we’ve seen that a lot right, Hartland we’ve got companies that have three giant clients, and then, maybe a bunch of other ones, but the overall percentage of revenue is held by these. You know three cornerstone clients which is kind of good.

Hartland: I was just going to say, the customer concentration, which is what that’s talking to, so yeah, certainly dangerous and will absolutely lead to a burnout type structure, partially or fully.

Erick: You threw the term burnout there, Yeah very good. Solid, predictable, top and bottom-line, predictable, consistent.

Erick: What else influences a higher valuation? Profit is maximized at every area of the organization, and believe it or not, profit does impact every business unit, right from operations and HR to service delivery, to marketing, to sales… fill in the blank. I mean there is a direct or a dotted line between profit and what happens in those business units and how they [ensure] that time is used productively and is well managed right. So we’re talking about documenting everything that we do from a service desk perspective and managing our costly billable technical resources. Business does not rely on the owner to function on a day-to-day basis. I know I’m kind of banging the door on that a lot, but that is very something that I want everyone to understand that if you’re in the market to sell at some point and exit, make sure that your main job is to replace yourself. That’s your priority, and what is the CEO’s function? To increase stakeholder value. So if you’re the CEO and the president and you are not taking steps to replace yourself so that the business operates autonomously, profitably, and successfully without you, you’re failing to increase shareholder value — even if you are the sole shareholder. So think about that.

Hartland: and I think that Erick this is a key one. I mean, I see this a lot and I think there’s also the other nuance here, which is not just operational aspects of it, but also the relationships with the customers. In other words, even if it all could work fine, but the customers still know you and still have your cell phone or whatnot and are kind of bypassing your systems or are expecting you to be part of those regular sales meetings, even if they’re someone’s annual., It’s all those things. So how tightly connected are you as an owner of the business.

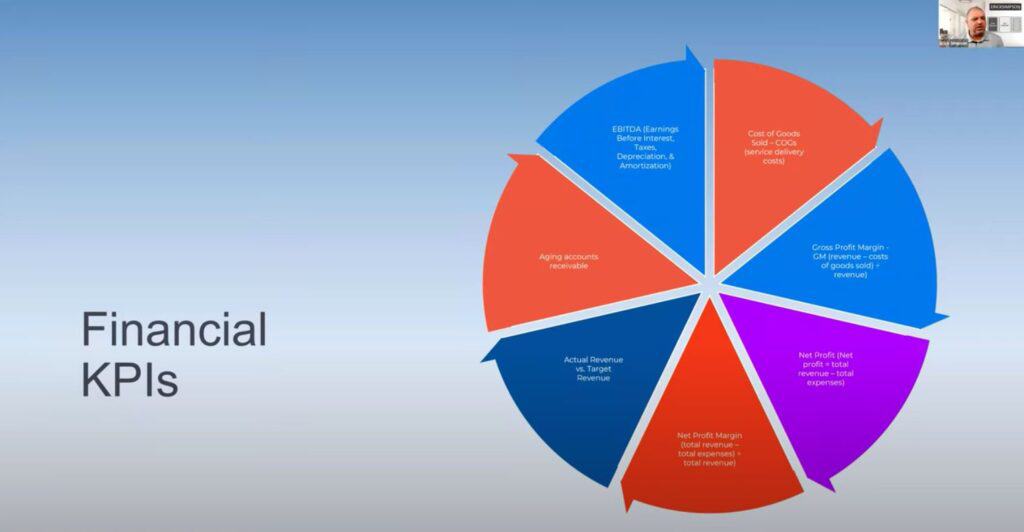

Erick: Exactly. So I skipped a few slides here, but again you’re going to get a full deck when you get these, but I just wanted to kind of land on the financial KPIs that are important. Your cost of goods sold, your gross profit margin, your net profit, your net profit margin, your actual revenue versus target revenue, your aging accounts receivable. We talked about some of these earlier. And your EBITDA, earnings before interest, taxes, depreciation and amortization. Some of us, in our early stages of business development, don’t really have a handle on our financials and really, have a challenge in managing that EBITDA. But it does come into play, no matter what percentage of your revenue is MRR, you still need to have a pretty healthy EBITDA for a financial buyer to have that increased valuation.

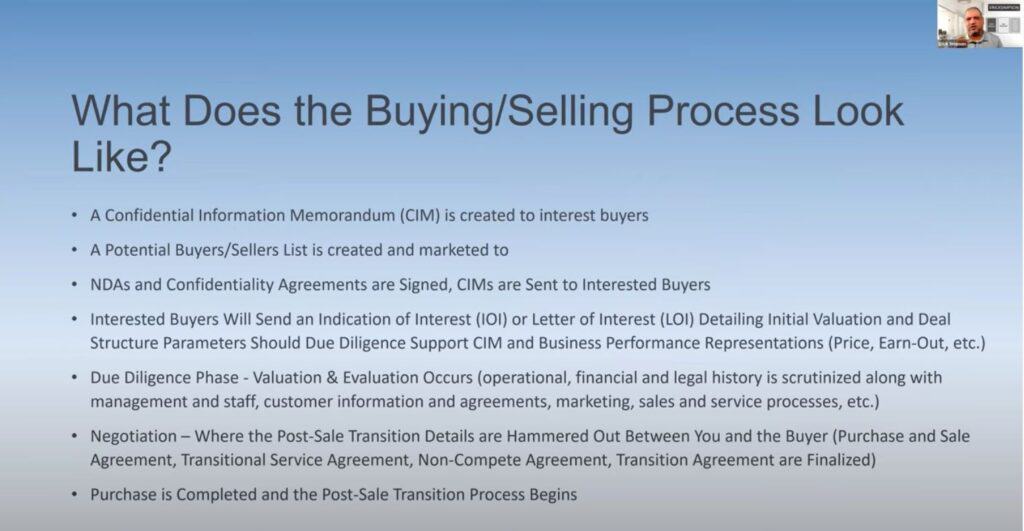

Erick: So I’m going to jump [ahead] really quickly and just kind of wrap up with: what does a buying selling process look like Hartland? These steps, there may be a few more [or] a few less depending upon [what] your ultimate process looks like, but in general it falls under this framework. A Confidential Information Memorandum is created [for] interested buyers. If you’re selling, a potential buyer/sellers list is created and marketed to. With this CIM, NDAs, and confidentiality agreements are signed and then we can have more open conversations. Interested buyers will send an indication of interest or a letter of interest, detailing kind of what they’re willing to do along with some deal structure in order to continue the conversation. If you like what they’re saying then there’s due diligence that goes on. This is kind of the microscope phase of the of the process here, where everything is going to be evaluated, then there’s some negotiation that happens and then ultimately you’ll either come to an agreement or you won’t; and if you do, you’ll complete the purchase and then you’ll move on to the post-sale transition and integration process. So I think I’m going to just land here and just reinforce.

Erick: Just the last thought here is if you haven’t done this before it is probably the most complex transaction you’ll ever have experienced, because it is. You might feel violated at the end of it because so much is uncovered and turned over to someone that you’re just trying to earn some trust [with] and build a relationship with. So make sure that you’re relying on the right team to help you through it.

Hartland: Yeah. I couldn’t agree more and I was just going to say the more I’m listening to you, and the more I’m kind of thinking about this, the more I realize that there’s a lot here that we could do some other sessions on. So if you’re interested, please. We list these webinars, that we do about every two or three weeks in our in our weekly mailings that we send out [featuring] companies for sale. We bring on guests like Erick, who’s fantastic today, and totally in alignment with everything that that we do. I think there’s a lot of additional topics that would be great for us to talk about it. I know we’re at the top of the hour, so I want to respect everybody’s time. If you have to jump off, I completely understand. I know I have one question that I wanted to ask you Erick before we go. Is there anything that you wanted to say yourself?

Erick: I’m good, so yeah go right ahead.

Hartland: So my question is just really, this is a personal one, is just sort of where do you see the managed IT services space in a number of years? I mean fast forward and you got a crystal ball for 15-20 years. Do you see there being a kind of like AWS/Azure type players in this space? There’s only a half dozen kind of large providers globally that are providing these types of services. Do you see it fragmented the way it is now? What are the types of services? How do you see that shaping up?

Erick: 20 years is a long time Hartland. You know it’s tough to predict, but here’s what I sense we’ll see over time: I think that there will be a shift in how we deliver services to small and medium business. I think enterprise folks will be the earliest adopters in some cases, but also kind of the latest adopters in other cases, and what I mean to say is we are moving toward the cloud. There will be a point in time Where the devices that companies and businesses use will not look like they look today. even Microsoft is moving away from heavy software installations and things like that and moving more towards apps. So what I think we’ll find is that everything will be more cloud-based, it’ll be more app-based, and the devices that we’ll interact with to do our processes will be primarily more mobile. I think that if we have to have a remote workforce in the future, we won’t have to go through an, okay…let’s get you to move all your equipment and, set you up at home and things like that. our workstations and things like that will be mobile. There will be, with the advent of 5g and things like that, we won’t have these problems that we’re having today with connectivity and things like that. I mean, I’m not saying that there won’t be problems, but I’m saying we will become a more WIFI enabled, 5g enabled, app and tablet and whatever enabled business. So where do the MSPs [fit]? They’ll be more focused on, like you said, the Azure, the AWS, the cloud. Those will be the opportunities and MSPs that’ll be the most successful will be the ones that will automate the support and the provisioning and the onboarding and ongoing care and maintenance of these customers. I don’t believe that that we will be using PSAs the way we’ll be using them today, because candidly, they are for a bygone era. We will have more cloud-based management tools that manage cloud services and provide security in the cloud. So that’s where I think we’re heading. I think that the on-premises stuff may have to be done, but I think there’ll be less and less on-prem necessary, especially in small and medium businesses, especially since the next generation of business owners are born in the cloud already. I mean my kids [don’t get their] noses out of their phones for a second. During the day they are on mobile apps, they’re on mobile devices, and this will be ubiquitous. So, in order for us to skate to where the puck is going to be, I think we’ll be focused more on the cloud and security and that kind of stuff and less on infrastructure. And I’m not saying it’s all going away. But I’m saying that the predominant support that we’ll be delivering will be managing these cloud platforms and apps.

Hartland: So as a Canadian, I love the hockey analogy. That’s a great one, I’ll steal that. What do you think, though, in terms of, what does this mean for MSPs in terms of support outside of s on-prem stuff and infrastructure or whatnot, but what about in terms of like support? Do you think these apps will become to the point where they’re so sort of intuitive, that there aren’t problems and they negate the need for MSPs to support them? I mean, is that a feasible outcome at some point?

Erick: I think that from an interactivity perspective, I think the apps will continue to become better and better at self-support and self-healing. I think the true value of the MSPs will be more in in data, in analytics, and security, and things like that. Helping an organization, because data in and of itself is valueless right? It’s the interpretation, it’s the ability to gather the data, to parse it, to interpret it, and to leverage it to make business decisions, and I think that’s where I see a more valued MSP player to be, more of a virtual CTO that helps organizations manage the day-to-day operation to be certain. But to really add additional value is to help collate [and] gather this data, produce it in a way that can be analyzed, and help in in the analysis of the data, being more strategically valuable than tactically valuable.

Hartland: Excellent! Well look, on that note, I’m going to [conclude]! We’ve gone over a few minutes here. So Erick, thank you very much, been a real pleasure. If you have any questions for Erick, it’s ErickSimpson.com. If you have any questions for us, it’s ebridgemarketingsolutions.com, or thehostbroker.com, or themspbroker.com. And feel free to reach out to us, by email: [email protected]. Happy to help you on the buyer’s side, sell side, and Erick on the structure of the business to enable one or both of those processes. So with that I’m going to leave everybody and thank you very much for attending, really appreciate your time today. Enjoy the rest of your day, enjoy the rest of your week and have a wonderful holiday. If I don’t talk to most of you before and coming up in a few weeks, happy holidays everyone.

Erick: Thanks Hartland, bye.

Interested in assistance selling your MSP? Looking to grow through acquiring an MSP? Contact The Host Broker today.